Axis and Citi Merger: All you need to know

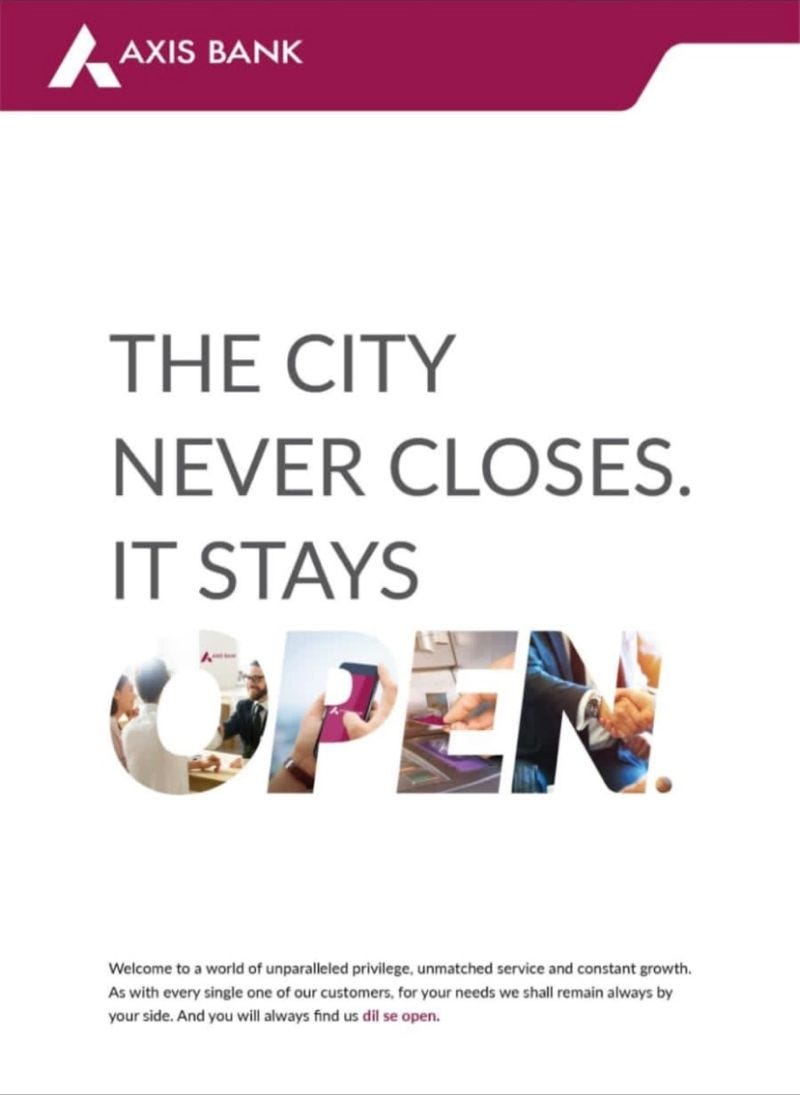

"The City Never Closes. It Stays Open"—read a front page advertisement by Axis Bank Ltd. on March 31, a take on Citibank's old tagline 'The Citi Never Sleeps'.

In April last year, Citigroup had said it will exit consumer businesses in 13 countries, including India, as it focuses on four wealth centres in Singapore, Hong Kong, the United Arab Emirates and London.

Citigroup had said the decision, taken as part of an ongoing strategic review, will allow Citi to direct investments and resources to the businesses where it has the greatest scale and growth potential.

On 3rd April, the private sector lender announced the acquisition of Citi India's local consumer finance businesses for Rs 12,325 crore. The Axis-Citi deal, in the works for close to 11 months, saw one of India's early success stories in retail finance change hands.

Axis Bank emerged as the lead buyer after beating rivals like Kotak, HDFC and DBS Bank.

For Citi, this marks a clean exit from the India consumer business. For Axis, it's a well-priced bet that the Citi clientele, particularly its affluent credit card holders, will give it a leg up in the retail banking business, where it stands third in the pecking order among private banks. The deal will help Axis Bank close the gap with larger peers like ICICI Bank and HDFC Bank.

Axis Bank is also keen to absorb nearly all the 3,600 employees working for the consumer banking business of Citi Bank.

If the customers agree to Axis managing their business, their accounts, credit cards and other business will change over, else the relationship will terminate.

The transaction is expected to take 9-12 months to complete.

Written by,

Wani Deoras